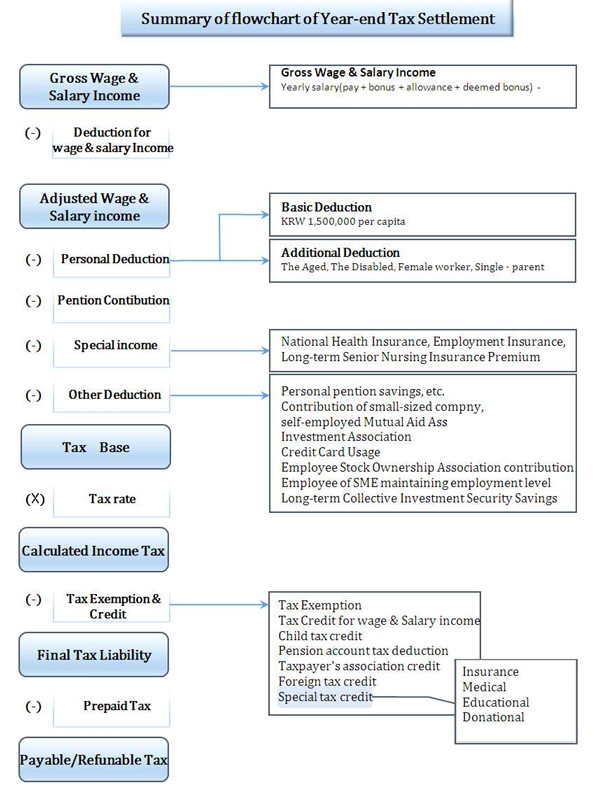

As a native English teacher, you will pay income tax on your earnings. Your school withholds this tax each month and sends it to the Korean tax authorities. At the end of January each year, or when leaving Korea, you need to complete a year-end tax settlement to finalize your tax liability. You are eligible for the same income deductions and tax credits as Korean workers.

Step-by-Step Guide for Year-End Tax Settlement (2024 Figures)

1. Calculate Gross Wage & Salary Income

(Annnual Wage & Salary Income (-) Non-Taxable Income)

2. Calculate Adjusted Wage & Salary Income

(Gross Wage & Salary Income (-) Wage & Salary Income Deduction)

- Based on your "Gross Wage & Salary" bracket, your income deduction differs (progressive)

- Most teachers fall within an annual wage between 15 Million KRW ~ 45 Million KRW

- E.g., Gross Wage & Salary Income = 30 Million KRW

- Adjusted Wage & Salary Income = (30 Mil. - 7.5 Mil. + (30 Mil./15 Mil. x 0.15)) = 22.5 Million KRW

Source: National Tax Service

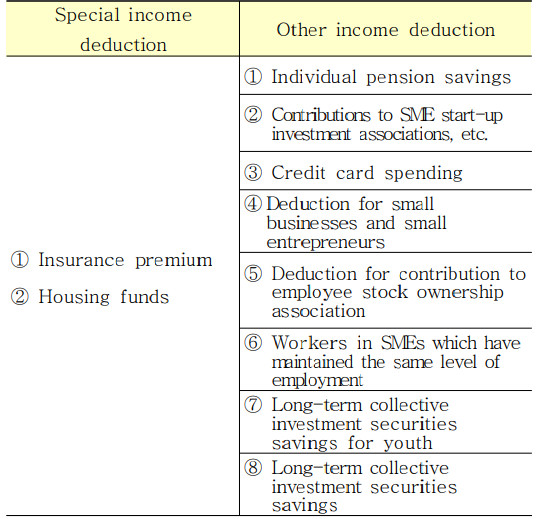

3. Calculate Tax Base

(Adjusted Wage & Salary Income (-) Other Deductions)

- E.g., Adjusted Wage & Salary Income = 22.5 Million KRW

- Pension Premium Deduction = 1.2 Million KRW

- Tax Base = (22.5 Mil. - 1.2 Mil.) = 21.3 Million KRW

Source: National Tax Service

4. Calculate Income Tax/Tax Amount

(Tax Base (x) Tax Rate)

- Based on your "Tax Base" bracket, your tax rate differs (progressive)

- Most teachers fall within a tax base of over 14 Million KRW ~ 50 Million KRW, or less

- E.g., Tax Base = 21.3 Million KRW

- Tax Amount (840,000 + (21.3 Mil. x 0.15)) = 4.035 Million KRW

Source: National Tax Service

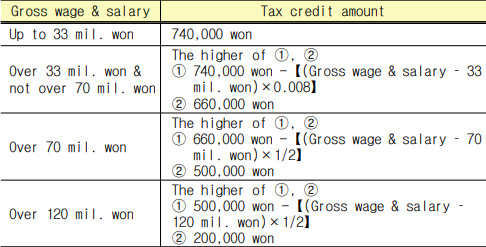

5. Calculate Final Tax Liability/Determined Tax Amount

(Calculated Tax Amount (-) Tax Exemption/Credit)

- Based on your "Gross Wage & Salary" bracket, your tax credit amount differs (progressive)

- E.g., Gross Wage & Salary Income = 30 Million KRW

- Tax Credit Amount = 740,000 KRW

Source: National Tax Service

Source: National Tax Service

6. Calculate Payable/Refundable Tax

(Determined Tax Amount (-) Prepaid Tax)

- Prepaid tax - Monthly amount withheld from wage & salary income according to the simplified tax withholding table (national tax) or at a 19% flat tax rate.*

- E.g., Determined Tax Amount = 740,000 KRW

- Prepaid Tax (35,600 x 12) = 427,200 KRW

- Tax Payable (740,000 - 427,200) = 312,800 KRW/year

Please note that year-end tax settlements vary not only based on your annual wage and salary income, but also on additional variables, such as your spending patterns (deductible expenses) and your family or dependent status.

According to the 2025 National Tax Statistics Yearbook, the average per-capita tax payment in 2023 was 1.13 million KRW. Additionally, approximately 28% of the population (14,899,752 people) received refunds, with an average refund amount of 824,358 KRW per person.

|

Note: Teachers may opt to pay a 19% flat tax instead of the standard progressive rate, which ranges from 6% to 45%, under Article 18-2 of the Restriction of Special Taxation Act. We don't recommend this option, as it's higher than the average tax burden for teachers. |

TAGS

Share

Embark Recruiting Blogs

Embark Recruiting

As former native English teachers in Korea, we know exactly what it’s like to navigate teaching abroad. That’s why we’re committed to increasing transparency in schools and improving Korea’s ESL teaching industry. At Embark Recruiting, we provide full support to help you succeed. Our blogs offer guidance, tips, and insider knowledge for teaching in Korea.